indiana estate tax threshold

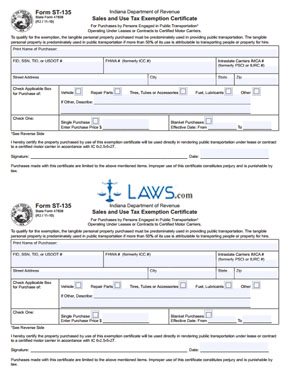

Includable Sales Gross Retail or Taxable When You Need to Register Once You Exceed the Threshold. This registration allows you to legally conduct retail sales in the state of.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

For example the renters deduction in.

. If you were a full-year resident of Indiana and your gross income the total of all your income before deductions was more than your total exemptions claimed then you must file an Indiana. Filing a typical tax return is simple but. Indiana Enacts Economic Nexus Legislation.

California Hawaii New York New. The Indiana personal exemption includes a 1500 additional. Gross revenue exceeds 100000 or 200 or more separate transactions.

A tax credit and a tax deduction both work to reduce the total amount of tax you pay. The Indiana individual adjusted gross income tax rate is 323. If your business sells goods or tangible personal property youll need to register to collect a seven percent sales tax.

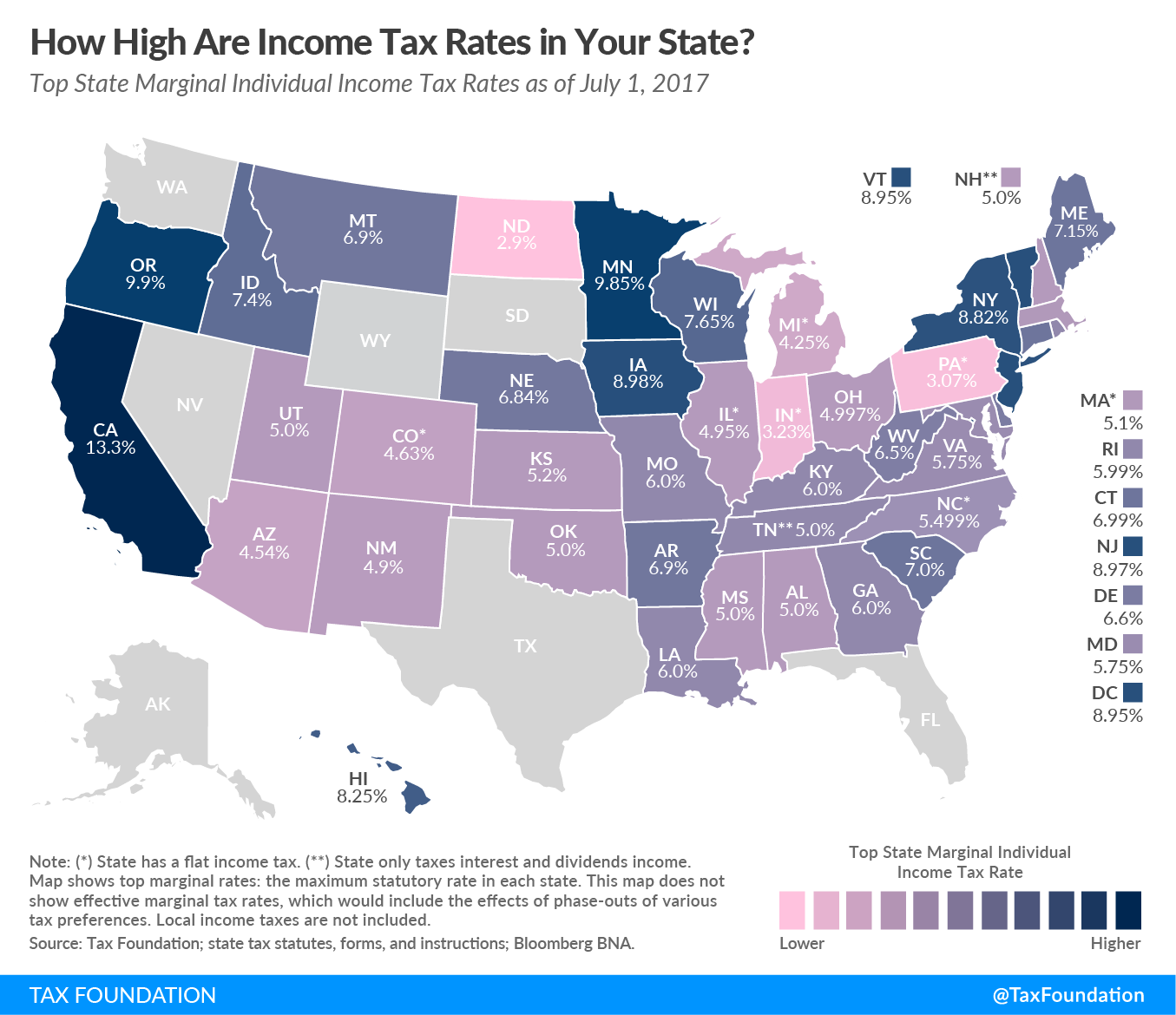

For purposes of this chapter motor vehicle does not include. Indiana HEA 1129 was challenged by a declaratory judgement action but that was resolved on August 27 2018 allowing the sales tax nexus changes to proceed. Overall state tax rates range from 0 to more than 13 as of 2021.

Note that for tax years 2020 and 2021 Texas Margins Tax provides for a no tax due threshold of 118 million of gross receipts. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption. 100000 in gross revenue in the previous calendar year or makes sales into Indiana in more than 200 separate transactions in the previous calendar year.

Location is everything if you want to save a few income tax dollars. The average income tax rate for counties and large municipalities is 116 according to the Tax Foundation weighted by income. Corporate and sales tax rates County tax rates County innkeepers tax Food-and-beverage rates.

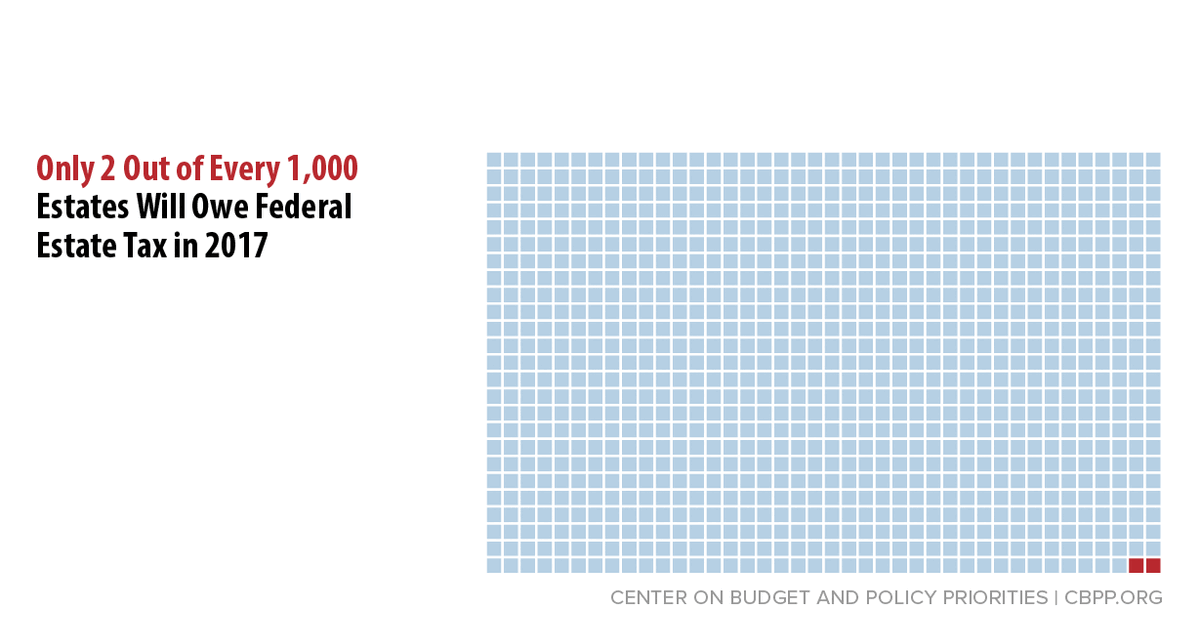

This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. Indiana Total Loss Threshold. The state-wide sales tax in Indiana is 7.

Up to 25 cash back Indiana Estate Planning. If you previously registered to file withholding sales FAB CIT or other trust taxes you must still file a 0 returns even if there is no tax revenue or activity for that period. Deductions reduce the amount of your income that is taxable.

Indiana has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state. If you dont have a physical presence in Indiana but you sell goods or tangible personal property into Indiana you will be required to collect tax if you meet Indianas sales thresholds of 200 or. Charge the tax rate of the.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

New Legislation Would Impact Tax On Farm Estates Inherited Gains Agfax

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Assessing The Impact Of State Estate Taxes Revised 12 19 06

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

A Guide To The Federal Estate Tax For 2021 Smartasset

How Inheritance Tax Works Howstuffworks

State Individual Income Tax Rates And Brackets Tax Foundation

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Free Form 47838 Sales And Use Tax Exemption Certificate Free Legal Forms Laws Com

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State By State Estate And Inheritance Tax Rates Everplans

How Do State Estate And Inheritance Taxes Work Tax Policy Center